Some Of Amur Capital Management Corporation

Some Of Amur Capital Management Corporation

Blog Article

Amur Capital Management Corporation - Truths

Table of Contents3 Easy Facts About Amur Capital Management Corporation DescribedSome Known Facts About Amur Capital Management Corporation.Little Known Facts About Amur Capital Management Corporation.4 Simple Techniques For Amur Capital Management CorporationThe Buzz on Amur Capital Management CorporationThe 7-Second Trick For Amur Capital Management CorporationThe Main Principles Of Amur Capital Management Corporation

A reduced P/E ratio might show that a firm is undervalued, or that capitalists expect the company to encounter harder times ahead. What is the excellent P/E ratio? There's no perfect number. However, financiers can use the average P/E ratio of other firms in the same industry to form a standard.

Unknown Facts About Amur Capital Management Corporation

The standard in the automobile and vehicle market is simply 15. A stock's P/E ratio is simple to find on many monetary reporting sites. This number suggests the volatility of a supply in comparison to the marketplace all at once. A safety with a beta of 1 will exhibit volatility that's the same to that of the market.

A stock with a beta of above 1 is in theory extra unpredictable than the market. As an example, a safety with a beta of 1.3 is 30% even more volatile than the marketplace. If the S&P 500 rises 5%, a supply with a beta of 1. https://www.nulled.to/user/6135857-amurcapitalmc.3 can be expected to rise by 8%

4 Simple Techniques For Amur Capital Management Corporation

EPS is a dollar number standing for the section of a company's profits, after taxes and favored stock dividends, that is allocated to each share of common stock. Financiers can utilize this number to assess just how well a company can deliver value to investors. A greater EPS begets greater share costs.

If a company on a regular basis falls short to deliver on profits forecasts, a capitalist may wish to reassess acquiring the stock - passive income. The estimation is easy. If a business has an earnings of $40 million and pays $4 million in rewards, then the remaining sum of $36 million is split by the number of shares outstanding

The smart Trick of Amur Capital Management Corporation That Nobody is Talking About

Financiers commonly obtain interested in a stock after checking out headlines concerning its extraordinary performance. An appearance at the trend in costs over the previous 52 weeks at the least is needed to get a feeling of where a supply's cost might go next.

Let's look at what these terms suggest, just how they vary and which one is finest for the ordinary financier. Technical analysts comb via massive quantities of data in an initiative to forecast the instructions of supply rates. The information is composed mostly of previous rates information and trading volume. Basic analysis fits the demands of many financiers and has the advantage of making good feeling in the real life.

They think costs adhere to a pattern, and if they can analyze the pattern published here they can take advantage of on it with well-timed professions. In current years, modern technology has actually made it possible for even more financiers to exercise this style of investing because the devices and the data are more accessible than ever before. Fundamental experts take into consideration the innate value of a stock.

See This Report about Amur Capital Management Corporation

Technical evaluation is best matched to someone that has the time and comfort level with data to place endless numbers to make use of. Over a duration of 20 years, yearly costs of 0.50% on a $100,000 financial investment will minimize the portfolio's value by $10,000. Over the same period, a 1% fee will certainly minimize the same profile by $30,000.

The fad is with you (https://www.awwwards.com/amurcapitalmc/). Take benefit of the trend and shop around for the cheapest price.

Not known Factual Statements About Amur Capital Management Corporation

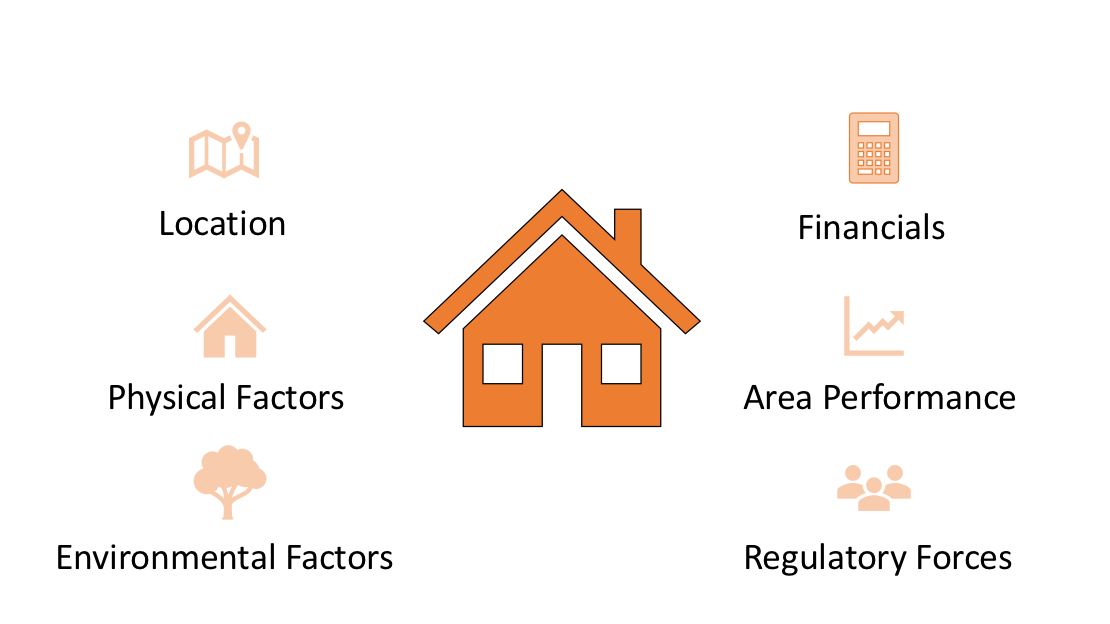

Closeness to features, green area, panoramas, and the community's standing variable prominently right into domestic property valuations. Nearness to markets, storehouses, transportation hubs, freeways, and tax-exempt locations play a crucial role in industrial building appraisals. A crucial when considering residential property location is the mid-to-long-term view relating to just how the location is expected to evolve over the investment period.

The Buzz on Amur Capital Management Corporation

Extensively evaluate the ownership and designated usage of the instant locations where you intend to spend. One means to accumulate details concerning the leads of the vicinity of the property you are thinking about is to contact the city center or various other public firms in charge of zoning and urban planning.

Property valuation is necessary for financing throughout the acquisition, market price, investment analysis, insurance policy, and taxationthey all depend upon realty appraisal. Typically used property evaluation techniques consist of: Sales contrast approach: recent similar sales of properties with comparable characteristicsmost usual and ideal for both new and old buildings Price strategy: the cost of the land and construction, minus devaluation ideal for new building Income strategy: based upon anticipated cash inflowssuitable for rentals Provided the low liquidity and high-value financial investment in property, an absence of clarity purposefully may result in unforeseen outcomes, including financial distressespecially if the investment is mortgaged. This uses normal income and long-term value admiration. This is typically for quick, tiny to tool profitthe typical property is under building and construction and offered at a profit on conclusion.

Report this page